- 1

- 2

- 3

- 4

FTX and the problem with centralization

Almost 2 months have gone by since the downfall of FTX, yet we still see it making headlines in every blockchain news outlet. While fraud and mismanagement are unfortunately not uncommon in crypto, the scale of these failures with FTX is unprecedented.

The recent failures have caused many to lose faith in the future of crypto, but it is important to note that these failures are not due to flawed software or blockchains themselves. Celsius Network. BlockFi, Voyager Digital, and FTX – are all centralized platforms that channeled the outdated big bank model under the guise of crypto. Despite their efforts to differentiate themselves, these businesses are just as susceptible to shady business practices, bank runs, uninsured accounts, and pump-and-dump scams as traditional banks.

The solution, therefore, is not the end of crypto, but a new investment in technology that goes back to the purpose of crypto: Decentralized Finance (Defi).

A quick guide to decentralized finance

What is Defi?

Defi includes financial products and services that are available to anyone with an internet connection and operate without the intervention of a bank or any other third-party company. Decentralized financial markets do not sleep and so transactions happen 24/7 in almost real-time, while no middleman has the power to stop them. You can store your cryptocurrency on your computer, in hardware crypto wallets, and elsewhere and access it at any time.

How can DeFi prevent the second FTX?

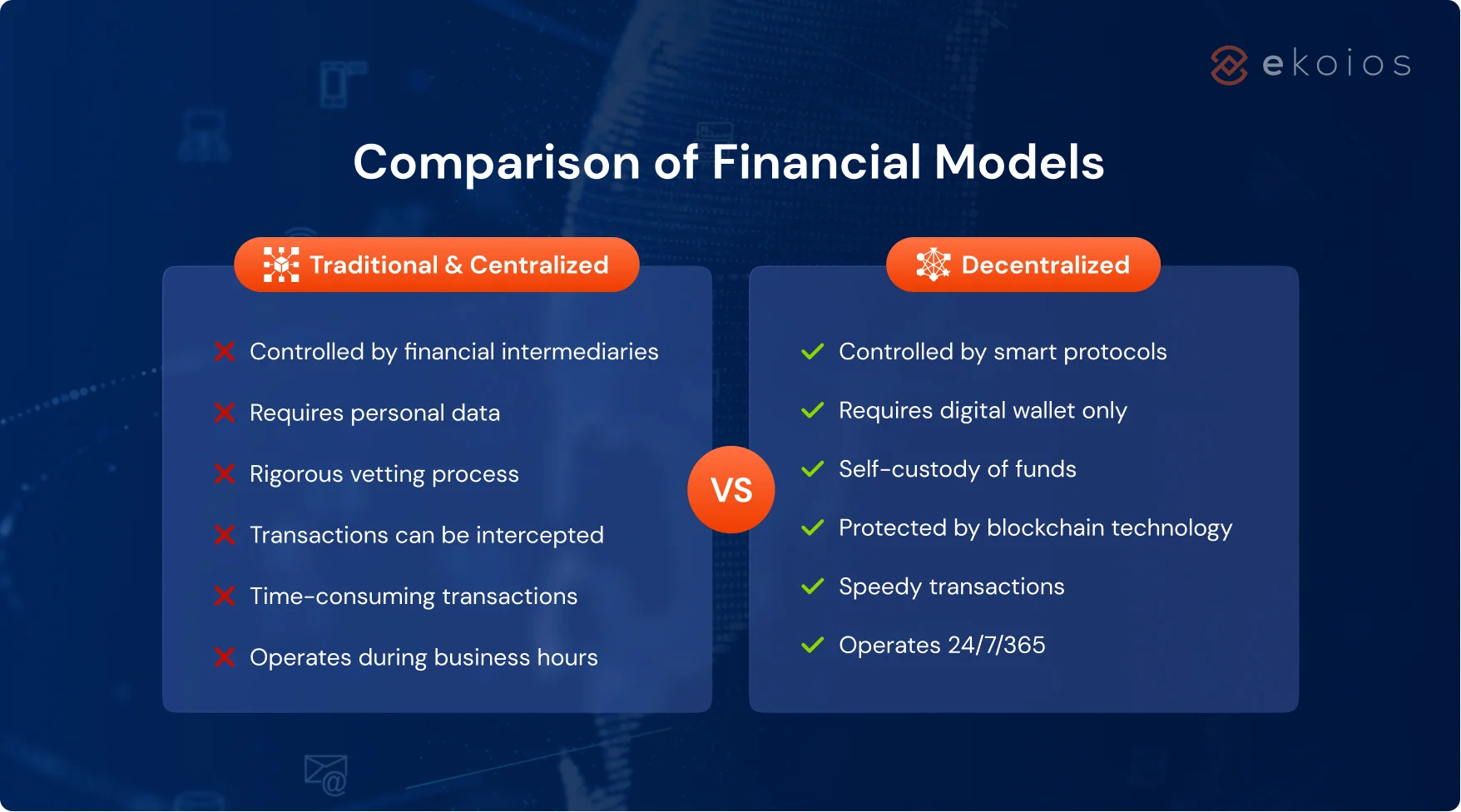

Thanks to blockchain technology, Defi transactions are made faster, cheaper, and – in some cases – more secure than with human intervention. It seeks to solve many of the problems that exist in traditional financial markets:

In centralized finance, people and/or companies handle the assets and processes. However, with decentralized finance, it’s a collection of smart protocols that gets the job done.

Defi will solve many of the problems plaguing the industry. Instead of trusting business leaders to be ethical, transparent, and accountable in their operations (see Sam Bankman-Fried’s “glowing” record), Defi is replacing them altogether with blockchain – open, transparent, and immutable. Instead of giving control of your funds to a third party – if any – Defi enables direct and instant peer-to-peer transactions. Instead of paying others to keep their money, users can control the process of lending money and receiving payments directly by themselves.

📌 Read more about applying blockchain in cross-border money transfer

How is Defi being used?

Here are some of the ways dApps and protocols are already being used:

- Financial transactions: Everything from payments, stock exchanges, and insurance to lending and borrowing is happening right now with Defi.

- Decentralized exchange (DEX): It facilitates peer-to-peer financial transactions and allows users to maintain control of their funds. Some popular exchanges are Uniswap, Curve, Coinbase, and Gemini.

- E-wallets: Digital wallets that can operate independently give investors access to all blockchain applications, from cryptocurrency to games.

- Stablecoins: While cryptocurrencies are notoriously volatile, stablecoins stabilize their values by tying to fiat money like the US dollar or other currencies.

- Yield farming: As the “rocket fuel” of crypto, users can lend or borrow crypto on a Defi platform and earn rewards in return for their services.

- Non-fungible tokens: NFTs create unique digital assets out of typically non-tradable assets, like videos of sports games, digital arts, or the first tweet on Twitter.

- Flash loans: Cryptocurrency loans that borrow and repay funds in the same transaction with a specific purpose.

What are the top Defi projects?

The Defi Marketplace measures adoption by measuring something called locked-in value, which calculates the number of coins currently active in various Defi protocols. As of December 2022, the total value locked in Defi protocols is close to $40 billion.

The top 5 Defi projects by total locked value are as follows:

- Dai (DAI) is a decentralized Stablecoin based on Ethereum (ETH) that aims to keep its value constant at $1, bringing stability to the wildly volatile crypto market. Dai tokens can be generated by using any Ethereum-based token as collateral in the form of smart contracts, or they can be purchased directly from any crypto exchange.

- Avalanche (AVAX) is a blockchain platform that runs on the proof-of-stake consensus mechanism, home to various dApps.

- Wrapped Bitcoin (WBTC) is an Ethereum ERC-20 token that serves as a digital representation of Bitcoin (BTC) on the Ethereum Blockchain. WBTC was designed to allow Bitcoin owners to participate in Ethereum’s popular DeFi apps.

- Uniswap (UNI): The largest permissionless decentralized cryptocurrency exchange. Rather than matching the bid and asking a centralized exchange to set the price, the platform algorithms determine the market price based on demand and supply, allowing buyers and sellers to trade directly from their wallets.

- Chainlink (LINK) is a decentralized blockchain oracle network based on the Ethereum Blockchain. It plans to provide off-chain data on the Blockchain via smart contracts, making it decentralized and secure.

Other measures to tighten security

Despite its perks, the current DeFi landscape still holds some significant limitations, namely over-collateralization, targeted hacks, complicated interfaces, and a lack of stop-loss functionality. Thus, while waiting for DeFi to fully mature, it’s important that we strengthen security on current practices to avoid further losses.

Self-custody assets

There’s a popular saying in crypto: “Not your keys, not your coins.” The safest way for anyone to hold cryptocurrency is in a wallet that they control. This can be done with a hardware wallet, such as a ledger or paper wallet, or in their own software wallet. It is important to note that the cryptographic foundation that cryptocurrencies use is nearly impossible to hack, creating tremendous security for assets held in a private wallet.

For many investors, this creates additional complexity when investing in cryptocurrency—there’s a certain level of technical knowledge required to use the self-custody method of storing crypto. However, in the spirit of complete security, it is worth learning how to do this.

Regulated custodians and exchanges

There needs to be a higher level of transparency for exchanges and stablecoins, as well as frameworks to publish their balance sheets, protect user assets, and maintain appropriate risk management controls in place.

It already happened – several platforms have announced that they will be releasing “proof of reserve,” a combination of cryptocurrency and traditional auditing that allows users to independently verify whether the platform’s assets match or exceed customer deposits.

At the same time, it seems that another important reason for FTX’s demise is the level of leverage it has over its assets. With the volatility present in crypto assets, exchanges need to reduce the leverage they incur.

What the future holds for the crypto

According to Dune Analytics, trading volumes on decentralized exchanges (DEXs) hit a whopping $32 billion just the week after FTX’s collapse, fuelled by investors’ withdrawal from centralized exchanges. This might be just the push the crypto community needs to return to decentralized principles, which was the very reason crypto was created in the first place. At the same time, we believe that the widely publicized collapse of FTX could dramatically accelerate the timeline for new regulations to usher in, bringing the power of blockchain technology to the masses.

To make sure nothing like this will happen again, we need safe, simple, decentralized tools and carefully regulated financial intermediaries. And that’s exactly what Ekotek Technology has always been committed to building. With 5+ years of experience in Defi solution development, we offer the expertise and resources to achieve business goals in this fast-changing landscape.

Check out our works: VC Crypto Wallet | TTX Staking Platform

Or book a free consultation with us to explore the realms of decentralized finance.

- 1

- 2

- 3

- 4